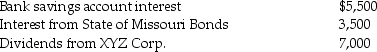

Kevin is a single person who earns $70,000 in salary for 2014 and has other income from a variety of investments,as follows:

Kevin received tax refunds when he filed his 2013 tax returns in April of 2014.His federal refund was $600 and his state refund was $300.Kevin claimed the $300 state tax overpayment as an itemized deduction on his 2013 return. Due to changes in circumstances,Kevin is not itemizing deductions on his 2014 return.

Kevin received tax refunds when he filed his 2013 tax returns in April of 2014.His federal refund was $600 and his state refund was $300.Kevin claimed the $300 state tax overpayment as an itemized deduction on his 2013 return. Due to changes in circumstances,Kevin is not itemizing deductions on his 2014 return.

Compute Kevin's taxable income for 2014.

Definitions:

Manufacture

Manufacture involves the process of converting raw materials into finished goods through various techniques and processes, typically involving labor and machinery.

Distribution

The act of presenting a product or service for utilization or consumption by a consumer or business entity.

Public Nuisance

An act or omission that obstructs, damages, or inconveniences the rights of the community or a significant number of people.

Health

The state of being free from illness or injury and includes physical, mental, and social well-being.

Q7: Identify which of the following statements is

Q29: Identify which of the following statements is

Q33: An individual is considered terminally ill for

Q41: Lynn transfers land having a $50,000 adjusted

Q69: Andrea died with an unused capital loss

Q71: Final regulations can take effect on any

Q73: Silvia transfers to Leaf Corporation a machine

Q89: A taxpayer may avoid tax on income

Q106: Under the economist's definition,unrealized gains,as well as

Q128: Because of the locked-in effect,high capital gains