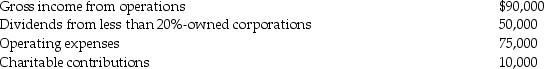

Dexter Corporation reports the following results for the current year:

In addition,Dexter has a $25,000 NOL carryover from the preceding tax year.What is Dexter's taxable income for the current year?

In addition,Dexter has a $25,000 NOL carryover from the preceding tax year.What is Dexter's taxable income for the current year?

Definitions:

Hallucinations

Experiencing sensations like sight, sound, or touch without any actual external inputs.

Schizophrenia

A mental disorder characterized by disturbances in thought, behavior, and emotions, often manifesting through delusions, hallucinations, and disorganized speech.

Positive Symptoms

In psychology, these refer to an excess or distortion of normal functions, often seen in schizophrenia, such as hallucinations or delusions.

Acute Schizophrenia

A sudden onset of schizophrenia symptoms, which could include delusions, hallucinations, disorganized speech, and impairment in functioning.

Q12: Bret carries a $200,000 insurance policy on

Q43: Hope receives an $18,500 scholarship from State

Q44: Your client wants to deduct commuting expenses

Q46: Itemized deductions are deductions for AGI.

Q52: Jonathon,age 50 and in good health,withdrew $6,000

Q58: Jack exchanged land with an adjusted basis

Q62: A child credit is a partially refundable

Q73: The standard deduction is the maximum amount

Q83: What is a constructive dividend? Under what

Q83: Amber supports four individuals: Erin,her stepdaughter,who lives