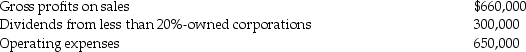

Carter Corporation reports the following results for the current year:

a)What is Carter Corporation's taxable income for the current year?

a)What is Carter Corporation's taxable income for the current year?

b)How would your answer to Part (a)change if Carter's operating expenses are instead $700,000?

c)How would your answer to Part (a)change if Carter's operating expenses are instead $760,000?

Definitions:

Separation

The action or state of moving or being moved apart, often used in contexts involving personal relationships, physical spaces, or psychological processes.

Childcare

The care and supervision of a child or multiple children at a time, which includes activities like education, providing basic needs, and ensuring safety.

Warning

A statement or event that signals a potential danger, problem, or other unpleasant situation.

Toddlers

Young children, typically aged one to three years, who are in the early stages of walking and developing speech.

Q8: Melody inherited 1,000 shares of Corporation Zappa

Q18: Distinguish between the Corn Products doctrine and

Q32: Mark purchased 2,000 shares of Darcy Corporation

Q36: An individual who is claimed as a

Q41: Net long-term capital gains receive preferential tax

Q45: The personal holding company tax might be

Q60: AAA Corporation distributes an automobile to Alexandria,a

Q119: Niral is single and provides you with

Q125: Jeffrey Corporation has asked you to prepare

Q127: Arthur,age 99,holds some stock purchased many years