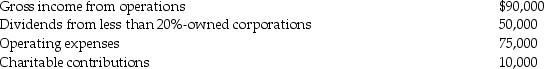

Dexter Corporation reports the following results for the current year:

In addition,Dexter has a $25,000 NOL carryover from the preceding tax year.What is Dexter's taxable income for the current year?

In addition,Dexter has a $25,000 NOL carryover from the preceding tax year.What is Dexter's taxable income for the current year?

Definitions:

Tangible Goods

Tangible goods are physical items that can be touched and seen, distinguished from services or digital products.

Intangible Services

Services that cannot be physically touched or stored, such as education, consulting, or legal advice.

Inventory

The quantity of goods that a company has in stock, ready for sale or distribution.

Investment Component

A part of economic activity related to spending on goods and services not for immediate consumption but for future benefit.

Q38: Becky places five-year property in service during

Q41: Jamal,age 52,is a human resources manager for

Q43: Hope receives an $18,500 scholarship from State

Q59: Identify which of the following statements is

Q59: The transferee corporation's basis in property received

Q62: Which of the following is not an

Q66: Gains and losses are recognized when property

Q93: In 2013 Betty loaned her son,Juan,$10,000 to

Q99: Dividends on life insurance policies are generally

Q120: You may choose married filing jointly as