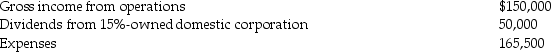

Dumont Corporation reports the following results in the current year:

What is Dumont's taxable income?

What is Dumont's taxable income?

Definitions:

Mutual Mistakes

A situation in contract law where all parties involved have a shared misunderstanding regarding a basic assumption that significantly impacts the contract.

Voidable Contracts

Contracts that are valid and enforceable on the surface but can be declared void by one or more of the parties due to certain reasons, like misrepresentation or lack of consent.

Innocent Misrepresentation

A false statement made about a material fact by a person who believed the statement was true.

Material Fact

An important fact that, if known, could influence a decision in a contract, transaction, or legal case. It is a fact that matters to the matter at hand.

Q8: Melody inherited 1,000 shares of Corporation Zappa

Q22: Michelle purchased her home for $150,000,and subsequently

Q31: In December of this year,Jake and Stockard,a

Q32: Nate sold two securities in 2014: <img

Q45: Discuss briefly the options available for avoiding

Q51: Family Corporation,a corporation controlled by Buddy's family,redeems

Q53: In a community property state,jointly owned property

Q61: Under both the accounting and tax law

Q72: This year,John,Meg,and Karen form Frost Corporation.John contributes

Q77: Outline and discuss the tax research process.