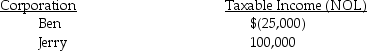

Ben and Jerry Corporations are members of the Ben-Jerry controlled group.The corporations file separate tax returns for the current year and report the following results:

a)If they elect no special apportionment plan,what is their combined tax liability?

a)If they elect no special apportionment plan,what is their combined tax liability?

b)If they DO elect a special apportionment plan,what is their lowest combined tax liability?

Definitions:

Studying Accounting

The process of learning about the systematic recording, reporting, and analysis of financial transactions of a business.

Tutoring

The act of providing one-on-one academic instruction to enhance a student's understanding of a specific subject.

Total Profit

The total income of a business after all expenses and costs have been subtracted from total revenue.

Willingness to Pay

The maximum price a consumer is prepared to pay for a good or service, reflecting its perceived value.

Q22: Tia owns 2,000 shares of Bass Corporation

Q23: Barry,Dan,and Edith together form a new corporation;

Q50: Organizational expenses incurred after 2004 are amortized

Q54: Darla sold an antique clock in 2014

Q58: Jack exchanged land with an adjusted basis

Q60: AAA Corporation distributes an automobile to Alexandria,a

Q69: Andrea died with an unused capital loss

Q106: Under the economist's definition,unrealized gains,as well as

Q112: Define Sec.306 stock.

Q117: Richards Corporation has taxable income of $280,000