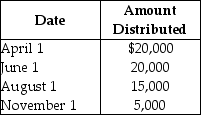

Payment Corporation has accumulated E&P of $19,000 and current E&P of $28,000.During the year,the corporation makes the following distributions to its sole shareholder:

The sole shareholder's basis in her stock is $45,000.What are the tax consequences of the June 1 distribution?

The sole shareholder's basis in her stock is $45,000.What are the tax consequences of the June 1 distribution?

Definitions:

Visual Acuity

The ability of the eye to see and distinguish fine details clearly.

Depth Perception

The ability to perceive the world in three dimensions and to judge the distance of objects accurately.

Potty Training

The process of teaching a young child to use the toilet for urination and defecation.

Operant Conditioning

A training technique that modifies the power of a behavior through the application of incentives or deterrents.

Q8: Which of the following statements about the

Q17: Child support is<br>A)deductible by both the payor

Q22: Ball Corporation owns 80% of Net Corporation's

Q34: The Small C corporation exemption from AMT

Q41: Flower Corporation,a C corporation but not a

Q47: On July 25,2013,Karen gives stock with a

Q48: Gains realized from property transactions are included

Q56: Ra Corporation issues a twenty-year obligation at

Q73: In the last three years,Wolf Corporation had

Q99: Dustin purchased 50 shares of Short Corporation