Multiple Choice

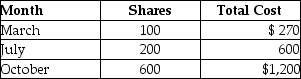

Edward purchased stock last year as follows:  In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

Definitions:

Related Questions

Q35: Walter,who owns all of the Ajax Corporation

Q36: A C corporation must use a calendar

Q38: In order for a taxpayer to deduct

Q46: Itemized deductions are deductions for AGI.

Q50: Mickey has a rare blood type and

Q50: When using the Bardahl formula,an increase in

Q80: In 2014,medical expenses are deductible as a

Q92: A plan of liquidation<br>A)must be written.<br>B)details the

Q94: Under the terms of a divorce agreement

Q104: Julia suffered a severe stroke and has