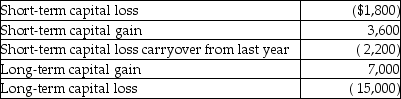

During the current year,Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

Definitions:

John Maynard Keynes

A British economist whose theories on the causes of prolonged unemployment and recommendations for government intervention in economies to stimulate demand and growth form the basis of Keynesian economics.

Adam Smith

An 18th-century Scottish economist and philosopher, best known for his works "The Wealth of Nations," which lays the foundations of classical economics.

Karl Marx

A 19th-century philosopher, economist, and political theorist known for his critical theories about capitalism and his influence on the development of socialist economic and political theory.

Classical Economists

Early economic theorists, primarily in the 18th and 19th centuries, who focused on the role of free markets in promoting economic growth and believed in minimal government intervention.

Q15: Ameriparent Corporation owns a 70% interest in

Q20: Becky places five-year property in service during

Q29: Identify which of the following statements is

Q42: Identify which of the following statements is

Q50: Jan purchased an antique desk at auction.For

Q58: Jack exchanged land with an adjusted basis

Q71: In a complete liquidation,a liability assumed by

Q71: Checkers Corporation has a single class of

Q72: Rita,who has marginal tax rate of 39.6%,is

Q85: In the current year,Red Corporation has $100,000