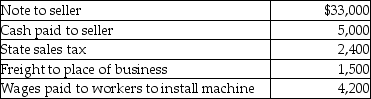

Dennis purchased a machine for use in his business.Mr.Dennis' costs in connection with this purchase were as follows:  What is the amount of Mr.Dennis' basis in the machine?

What is the amount of Mr.Dennis' basis in the machine?

Definitions:

Secure Attachment

A stable and healthy emotional bond between an infant and their caretaker, characterized by trust and a sense of safety.

Insecure Attachment

A type of attachment characterized by fear, anxiety, or uncertainty in relationships, resulting from inconsistent caregiver responses.

Emotional Regulation

Techniques for controlling one’s emotional states.

Negative Emotionality

Characterizes individuals who frequently experience and express negative emotions such as anger, anxiety, or sadness.

Q21: Deductions for adjusted gross income include all

Q48: Margaret died on September 16,2014,when she owned

Q51: Discuss why the distinction between deductions for

Q68: Khuns Corporation,a personal holding company,reports the following:<br>

Q71: The recipient of a taxable stock dividend

Q73: Ahmad's employer pays $10,000 in tuition this

Q90: Laura,the controlling shareholder and an employee of

Q98: Quality Corporation,a regular corporation,has an opportunity to

Q99: New York Corporation adopts a plan of

Q110: A taxpayer had the following income and