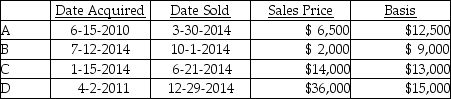

Coretta sold the following securities during 2014:  What is Coretta's net capital gain or loss result for the year?

What is Coretta's net capital gain or loss result for the year?

Definitions:

Interperiod Tax Allocation

The process of distributing tax expenses or benefits over different accounting periods due to temporary differences between financial accounting and tax accounting rules.

Effective Tax Rate

The average rate at which an individual or corporation is taxed, calculated by dividing the total tax paid by taxable income.

Income Tax Expense

The amount of money a company or individual owes in taxes based on their taxable income for a given period.

Pre-tax Book Income

The income a company reports to investors before the application of income tax and other deductions as per accounting standards.

Q5: Identify which of the following statements is

Q8: In a taxable distribution of stock,the recipient

Q22: For corporations,what happens to excess charitable contributions?

Q40: Unlike an individual taxpayer,the corporate taxpayer does

Q45: Identify which of the following statements is

Q48: Ball Corporation owns 80% of Net Corporation's

Q57: Mattie has group term life insurance coverage

Q57: Interest incurred during the development and manufacture

Q70: The Sec.318 family attribution rules can be

Q79: The following expenses are incurred by Salter