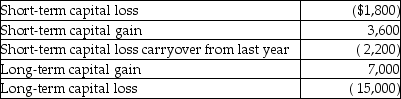

During the current year,Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

Definitions:

Proof

Evidence or argument establishing or helping to establish a fact or the truth of a statement.

Fallacious Arguments

Reasoning that contains flaws in logic or premise, leading to invalid conclusions or misleading assertions.

Evaluative Adjectives

Adjectives that express a value judgment or assessment about the noun they modify.

Premises

Statements or propositions upon which an argument is based or from which a conclusion is drawn.

Q16: An individual shareholder owns 3,000 shares of

Q18: Wind Corporation is a personal holding company.Its

Q24: All of the following items are excluded

Q29: Hope Corporation was liquidated four years ago.Teresa

Q47: Identify which of the following statements is

Q48: Which of the following factors is not

Q48: Poppy Corporation was formed three years ago.Poppy's

Q58: Identify which of the following statements is

Q81: Which of following generally does not indicate

Q117: Generally,gains resulting from the sale of collectibles