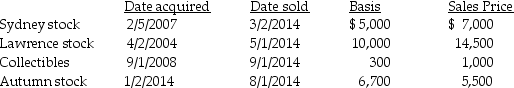

Chen had the following capital asset transactions during 2014:

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

Definitions:

Perception

The process by which sensory information is interpreted and organized to understand the environment.

Object's Size

A measurement of the physical dimensions or magnitude of an object.

Brightness Constancy

A visual perception feature where the perceived brightness of an object remains constant despite changes in illumination.

Light Reflected

The bouncing back of light rays from the surface of an object, which is a key principle in how we see and perceive the visual world.

Q17: Toby made a capital contribution of a

Q21: Chip and Dale are each 50% owners

Q30: When both borrowed and owned funds are

Q49: Healthwise Ambulance requires its employees to be

Q49: The initial adjusted basis of property depends

Q52: Identify which of the following statements is

Q83: Which of the following entities is subject

Q84: Each year a taxpayer must include in

Q85: Christopher,a cash basis taxpayer,borrows $1,000 from ABC

Q111: Jeffrey,a T.V.news anchor,is concerned about the wrinkles