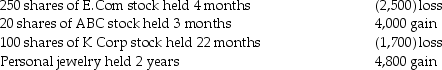

Trista,a taxpayer in the 33% marginal tax bracket sold the following capital assets this year:

What is the amount of and nature of (LT or ST)capital gain or loss? Be specific as to the rates at which gains,if any,are taxed.

What is the amount of and nature of (LT or ST)capital gain or loss? Be specific as to the rates at which gains,if any,are taxed.

Definitions:

Discounts

Reductions applied to the selling price of goods or services for promotions, bulk purchases, or other reasons.

Sold

Refers to the act of exchanging a product or service for money or other compensation; a completed transaction.

Discount

A reduction from the usual cost of something, usually provided as an incentive to increase sales.

Outstanding Balance

Outstanding Balance refers to the amount of money owed on a loan or credit that has not yet been repaid.

Q4: When is E&P measured for purposes of

Q7: Expenditures for a weight reduction program are

Q23: Parent Corporation owns 100% of the stock

Q39: ASC 740 requires that<br>A)the AMT is not

Q59: Identify which of the following statements is

Q61: Explain the difference in tax treatment between

Q79: Foster Corporation has gross income for regular

Q80: Circle Corporation has 1,000 shares of common

Q119: If property that qualifies as a taxpayer's

Q124: Gabby owns and operates a part-time art