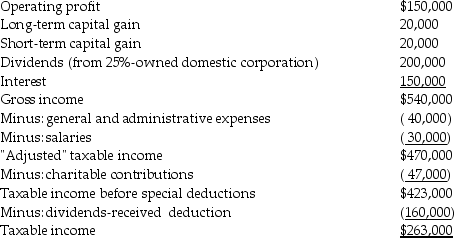

Mullins Corporation is classified as a PHC for the current year,reporting $263,000 of taxable income on its federal income tax return:

Actual charitable contributions made by Mullins Corporation were $75,000.What are the federal income tax due and the personal holding company (PHC)tax liability? Discuss the methods (if any)by which payment of the PHC tax can be avoided.

Actual charitable contributions made by Mullins Corporation were $75,000.What are the federal income tax due and the personal holding company (PHC)tax liability? Discuss the methods (if any)by which payment of the PHC tax can be avoided.

Definitions:

Unit Of Account

A commonly used numerical value that measures the market price of goods, services, and various transactions.

Commodity Money

Money that has intrinsic value because it is made of a commodity with its own value, such as gold or silver.

Intrinsic Value

The inherent or true value of an asset, investment, or company, based on underlying perception of its true value including all aspects of the business.

First Bankers

This refers to individuals or institutions that were among the earliest to engage in banking activities, such as accepting deposits and making loans.

Q4: Which of the following statements regarding the

Q8: While payments received because a person has

Q22: Britney is beneficiary of a $150,000 insurance

Q23: Digger Corporation has $50,000 of current and

Q31: During the current year,Donna,a single taxpayer,reports the

Q42: On January 31 of this year,Jennifer pays

Q58: Jack exchanged land with an adjusted basis

Q67: Identify which of the following statements is

Q77: What are start-up expenditures?

Q90: A nonbusiness bad debt is deductible only