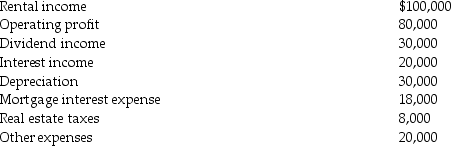

Lake Corporation is a personal holding company.Lake reports the following results for the current year:

No dividends are paid during the current year or the 2-and-one-half-month throwback period.The mortgage relates to the rental properties.Calculate the adjusted income from rents exclusion from personal holding company income.

No dividends are paid during the current year or the 2-and-one-half-month throwback period.The mortgage relates to the rental properties.Calculate the adjusted income from rents exclusion from personal holding company income.

Definitions:

Trail Of Tears

Cherokees’ own term for their forced removal, 1838–1839, from the Southeast to Indian lands (later Oklahoma); of 15,000 forced to march, 4,000 died on the way.

Seminole Indians

A Native American tribe originally from Florida, known for its resistance against U.S. military campaigns.

Florida

A southeastern U.S. state known for its beaches, theme parks, and as a popular destination for retirees.

Oklahoma

A state located in the south-central region of the United States.

Q12: The gross estate of a decedent contains

Q26: Which of the following items will result

Q38: Define the seven classes of assets used

Q43: An accrual-basis corporation can only deduct contributions

Q45: Terrell and Michelle are married and living

Q54: Paris Corporation has E&P of $200,000.Paris owns

Q65: In September of 2014,Michelle sold shares of

Q67: One consequence of a property distribution by

Q95: If an activity produces a profit for

Q102: Jones,Inc.,a calendar-year taxpayer,is in the air conditioner