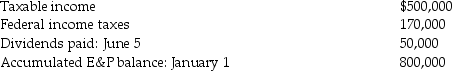

Lawrence Corporation reports the following results during the current year:

No dividends were paid in the throwback period.A long-term capital gain of $50,000 is included in taxable income.The statutory accumulated earnings tax exemption has been used up in prior years.An additional earnings accumulation of $60,000 for the current year can be justified as meeting the reasonable needs of the business.What is Lawrence Corporation's accumulated earnings tax liability?

No dividends were paid in the throwback period.A long-term capital gain of $50,000 is included in taxable income.The statutory accumulated earnings tax exemption has been used up in prior years.An additional earnings accumulation of $60,000 for the current year can be justified as meeting the reasonable needs of the business.What is Lawrence Corporation's accumulated earnings tax liability?

Definitions:

Trademark

A symbol, word, or phrase legally registered or established by use as representing a company or product.

Patent

A patent is a legal right granted to an inventor or assignee, providing exclusive ownership over an invention for a certain period, typically 20 years.

Legal Life

The duration for which legal protection is granted to an intangible asset, such as a patent or copyright.

Useful Life

Refers to the estimated duration an asset is expected to remain functional and useful for its intended purpose before it requires replacement.

Q1: Leslie,who is single,finished graduate school this year

Q14: Patrick's records for the current year contain

Q37: Martina,who has been employed by the Smythe

Q53: Junod Corporation's book income is $500,000.What tax

Q75: Mountaineer,Inc.has the following results: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5381/.jpg" alt="Mountaineer,Inc.has

Q76: Sumedha is the beneficiary of her mother's

Q91: Baxter Corporation transfers assets with an adjusted

Q104: On December 10,2011,Dell Corporation (a calendar-year taxpayer)accrues

Q112: Bad debt losses from nonbusiness debts are

Q121: On December 1,Robert,a cash method taxpayer,borrows $10,000