During the current year,Lucy,who has a sole proprietorship,pays legal and accounting fees for the following:

Services rendered in resolving a federal tax deficiency

Services rendered in resolving a federal tax deficiency

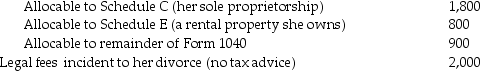

Tax return preparation fees:

Tax return preparation fees:

What amount is deductible for AGI?

What amount is deductible for AGI?

Definitions:

Charting By Exception (CBE)

A documentation strategy in nursing where only significant findings or deviations from norms are recorded.

Narrative Format

A method of writing or presenting information in the form of a story or account of events.

Patient Care

The services rendered by healthcare professionals to individuals seeking to improve or maintain their health status.

Telephone Prescription

The act of a healthcare provider giving a prescription order through a phone call, typically followed by written confirmation.

Q2: Carol contributes a painting to a local

Q3: A stock acquisition that is not treated

Q10: Which of the following is not required

Q35: Property received in a corporate liquidation by

Q38: Identify which of the following statements is

Q42: Explain the rules for determining whether a

Q52: Parent Corporation purchases all of Target Corporation's

Q73: Are liquidation and dissolution the same? Explain

Q89: White Corporation is a calendar-year taxpayer.Wilhelmina owns

Q122: Sanjay is single and has taxable income