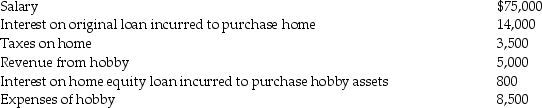

During the current year,Paul,a single taxpayer,reported the following items:

Compute Paul's taxable income for the year.

Compute Paul's taxable income for the year.

Definitions:

Taxable Temporary Difference

The difference between the tax base of an asset or liability and its carrying amount in the financial statements that will result in taxable amounts in future periods.

Deferred Tax Asset

An accounting term that refers to a situation where a company has paid more taxes to the government than it has shown as an expense in its financial statements, leading to future tax savings.

Deferred Tax Liability

A tax obligation that a company owes but is allowed to pay at a later date, often due to timing differences between accounting practices and tax laws.

Future Tax

Tax liabilities or assets that are expected to be realized in the future, typically as a result of temporary differences between the book and tax bases of assets and liabilities.

Q27: American Healthcare (AH),an insurance company,is trying to

Q32: Which of the following item(s)must be included

Q37: Points paid to refinance a mortgage on

Q41: Jamal,age 52,is a human resources manager for

Q61: Expenditures for long-term care insurance premiums qualify

Q73: The total worthlessness of a security generally

Q86: Corporate distributions that exceed earnings and profits

Q87: Peter is assessed $630 for street improvements

Q100: What are the advantages and disadvantages of

Q116: Olivia,a single taxpayer,has AGI of $280,000 which