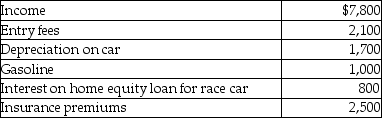

Kyle drives a race car in his spare time and on weekends.His records regarding this activity reflect the following information for the year.  What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

Definitions:

Elasticity of Demand

A measure of how much the quantity demanded of a good responds to a change in the price of that good, with all other things being equal.

Price Ceiling

A government-imposed limit on how high a price can be charged for a product or service, typically set below the market equilibrium price.

Shortage/Surplus

A market condition where the quantity of a good supplied is not equal to the quantity demanded, with a shortage being a deficit and a surplus being an excess.

Minimum Wage

The lowest legal hourly pay rate that employers can pay to workers.

Q1: If a loan has been made to

Q3: Jorge owns activity X which produced a

Q12: Mountaineer,Inc.has the following results: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5381/.jpg" alt="Mountaineer,Inc.has

Q19: If the principal reason for a taxpayer's

Q23: Digger Corporation has $50,000 of current and

Q32: List those criteria necessary for an expenditure

Q36: In determining accumulated taxable income for the

Q43: This year,Lauren sold several shares of stock

Q56: Dana purchased an asset from her brother

Q68: For purposes of the application of the