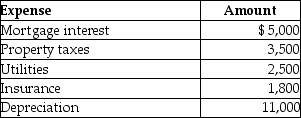

Mackensie owns a condominium in the Rocky Mountains.During the year,Mackensie uses the condo a total of 23 days.The condo is also rented to tourists for a total of 77 days and generates rental income of $10,900.Mackensie incurs the following expenses in the condo:  Using the court's method of allocating expenses,the amount of depreciation that Mackensie may take with respect to the rental property will be

Using the court's method of allocating expenses,the amount of depreciation that Mackensie may take with respect to the rental property will be

Definitions:

Direct Foreign Investment

Investment made by a company or individual in one country in business interests in another country, in the form of either establishing business operations or acquiring business assets in the other country.

International Joint Ventures

Collaborative enterprise agreements between two or more companies from different countries, aiming to achieve specific business goals.

Success Rate

Indicates the proportion or percentage of achieved objectives or completed tasks against attempted ones within a defined period.

Internationalization Process

Involves adapting businesses and strategies to fit foreign markets and cultural practices to ensure global competitiveness.

Q23: Roby Corporation,a Tennessee corporation,decides to change its

Q25: Contributions to political candidates are not deductible

Q31: The following information is reported by Acme

Q33: Which of the following is not permitted

Q50: If a liquidating subsidiary corporation primarily has

Q74: For a bad debt to be deductible,the

Q79: Legal fees for drafting a will are

Q86: Corporate distributions that exceed earnings and profits

Q90: In a Sec.338 election,the target corporation<br>A)will no

Q96: Identify which of the following statements is