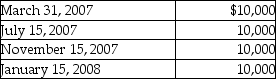

Sandy,a cash method of accounting taxpayer,has a basis of $46,000 in her 500 shares of Newt Corporation stock.She receives the following distributions as part of Newt's plan of liquidation.  The amount of the final distribution is not known on December 31,2007.What are the tax consequences of the distributions?

The amount of the final distribution is not known on December 31,2007.What are the tax consequences of the distributions?

Definitions:

Photo Identification

A document containing a photograph of the bearer, used to verify the individual's identity against their face, commonly including ID cards, passports, and driver's licenses.

Wealth Gap

The unequal distribution of assets across a population.

Inherited Properties

Attributes, possessions, or genetic traits transmitted from parents to their offspring through genes or by legal means after death.

Federal Minimum Wage

The lowest hourly wage that employers can legally pay their workers as mandated by the U.S. federal government.

Q15: In 2006,Regina purchased a home in Las

Q17: If a loss is disallowed under Section

Q53: Interest expense incurred in the taxpayer's trade

Q74: Business investigation expenses incurred by a taxpayer

Q76: Identify which of the following statements is

Q87: Parent Corporation,which operates an electric utility,created a

Q91: Taxpayers are allowed to recognize net passive

Q99: Dustin purchased 50 shares of Short Corporation

Q106: Which of the following factors is important

Q109: Boris owns 60 of the 100 shares