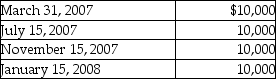

Sandy,a cash method of accounting taxpayer,has a basis of $46,000 in her 500 shares of Newt Corporation stock.She receives the following distributions as part of Newt's plan of liquidation.  The amount of the final distribution is not known on December 31,2007.What are the tax consequences of the distributions?

The amount of the final distribution is not known on December 31,2007.What are the tax consequences of the distributions?

Definitions:

Misleading Cues

Incorrect signals or information that can lead to false assumptions or interpretations.

Stroboscopic

Referring to a visual phenomenon where continuous motion is represented by a series of short or intermittent light pulses, creating the illusion of movement.

Similarity Principle

A concept in social psychology that suggests individuals are more likely to form relationships with people who are similar to them in terms of interests, beliefs, and background.

Perceptual Organization

The process by which the brain systematically interprets and gives meaning to sensory input, organizing it into coherent images and experiences.

Q6: The personal holding company penalty tax rate

Q16: When the taxpayer anticipates a full recovery

Q23: Joy reports the following income and loss:

Q24: What are the tax consequences to Parent

Q27: The alternative minimum tax is the excess

Q42: A personal property tax based on the

Q58: Bruce receives 20 stock rights in a

Q67: Toby,owner of a cupcake shop in New

Q72: Identify which of the following statements is

Q116: Olivia,a single taxpayer,has AGI of $280,000 which