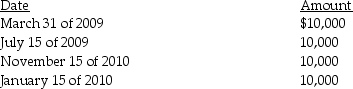

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset).The stock was acquired three years ago.He receives the following distributions as part of a plan of liquidation of Acorn Corporation:

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

Definitions:

Variable Cost

Costs that vary directly with the level of production or output in a company, such as raw materials and labor expenses.

Total Cost

refers to the sum of all expenses incurred in the production of goods or services, including fixed and variable costs.

Computer Software

Programs and operating information used by a computer to perform specific tasks.

Average Fixed Cost

The total fixed costs of production divided by the quantity of output produced, illustrating how fixed costs dilute over larger quantities of output.

Q11: Lake City Corporation owns all the stock

Q36: On Form 1040,deductions for adjusted gross income

Q46: What type of property should be transferred

Q52: A charitable contribution deduction is allowed for

Q55: The maximum tax deductible contribution to a

Q64: How does the deduction for U.S.production activities

Q65: Intercompany sales between members of an affiliated

Q72: An expense is considered necessary if it

Q79: Under Illinois Corporation's plan of liquidation,the corporation

Q89: Incremental expenses of an additional night's lodging