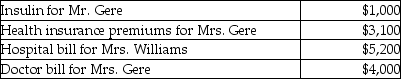

Mr.and Mrs.Gere,who are filing a joint return,have adjusted gross income of $50,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Gere's mother,Mrs.Williams.The Gere's could claim Mrs.Williams as their dependent,but she has too much gross income.  Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Efficient Bureaucracy

A system of organization that is effectively structured with clear rules and procedures to ensure maximum productivity and efficiency.

Low-Cost Leadership

A business strategy focused on becoming the lowest cost producer in an industry for a certain level of product quality.

James D. Thompson

A sociologist known for his contributions to organizational theory, particularly for his work on organizations as open systems.

Joan Woodward

A British sociologist known for her research in industrial organization and the impact of technology on management and organizational structure.

Q12: Lake Corporation distributes a building used in

Q16: Which of the following statements regarding the

Q18: Wind Corporation is a personal holding company.Its

Q30: Why should a corporation that is 100%

Q54: If a taxpayer suffers a loss attributable

Q68: Everest Inc.is a corporation in the 35%

Q76: In the current year,Julia earns $9,000 in

Q85: Broom Corporation transfers assets with an adjusted

Q99: Assessments made against real estate for the

Q121: If an employee incurs travel expenditures and