Phoebe's AGI for the current year is $120,000.Included in this AGI is $100,000 salary and $20,000 of interest income.In earning the investment income,Phoebe paid investment interest expense of $30,000.She also incurred the following expenditures subject to the 2% of AGI limitation:

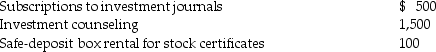

Investment expenses:

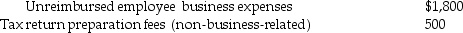

Noninvestment expenses:

Noninvestment expenses:

What is Phoebe's investment interest expense deduction for the year?

What is Phoebe's investment interest expense deduction for the year?

Definitions:

Complex Feeding

Refers to the intricate interactions and food webs in ecosystems, involving multiple levels of producers, consumers, and decomposers.

Biological Diversity

The variety and variability of life on Earth, including diversity within species, between species, and of ecosystems.

Biodegradable

Materials that can be broken down into natural elements by microorganisms over time, without harming the environment.

Decomposers

Organisms such as fungi and bacteria that break down dead organic material, returning nutrients to the ecosystem.

Q13: Zebra Corporation transfers assets with a $120,000

Q19: H (age 50)and W (age 48)are married

Q24: What are the tax consequences to Parent

Q26: Which of the following definitions of Sec.338

Q27: American Healthcare (AH),an insurance company,is trying to

Q40: Parent and Subsidiary Corporations are members of

Q52: Generally,expenses incurred in an investment activity other

Q63: The minimum tax credit available for a

Q79: Under Illinois Corporation's plan of liquidation,the corporation

Q80: Brandon,a single taxpayer,had a loss of $48,000