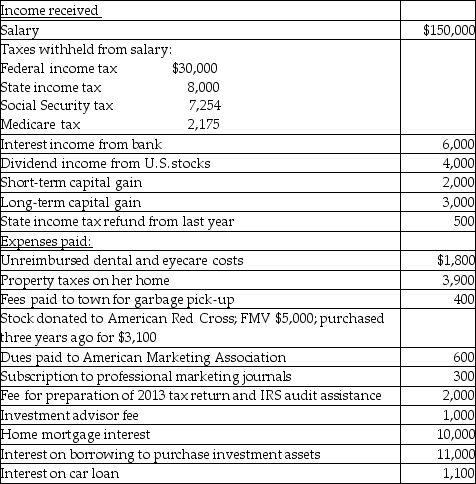

Hope is a marketing manager at a local company. Information about her 2014 income and expenses is as follows:

Compute Hope's taxable income for the year in good form. Show all supporting computations. Hope is single,and she elects to itemize her deductions each year.Assume she does not make any elections regarding the investment interest expense. Also assume that her tax profile was similar in the preceding year.

Compute Hope's taxable income for the year in good form. Show all supporting computations. Hope is single,and she elects to itemize her deductions each year.Assume she does not make any elections regarding the investment interest expense. Also assume that her tax profile was similar in the preceding year.

Definitions:

Vouchers Payable

An accounting term that represents the obligation of a business to pay for goods or services that have been received, but not yet paid for.

Purchases Discount

A contra-cost account in the general ledger that records discounts offered by vendors of merchandise for prompt payment of purchases by buyers.

Merchandise

Goods brought into a store for resale to customers.

Purchase Discounts

Reductions in price given by a supplier to a buyer for early payment within a specified period.

Q24: Drury Corporation,which was organized three years ago,reports

Q46: Stacy,who is married and sole shareholder of

Q49: Identify which of the following statements is

Q60: Corporations issuing incentive stock options receive a

Q62: Which of the following is not an

Q62: A corporation is required to file Form

Q81: During 2014,Marcia,who is single and is covered

Q100: Corporations cannot use the installment method in

Q100: What are the advantages and disadvantages of

Q104: Rashad contributes a machine having a basis