MrAnd MrsThibodeaux,who Are Filing a Joint Return,have Adjusted Gross Income of of $75,000.During

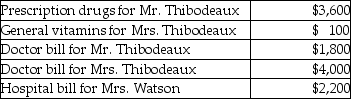

Mr.and Mrs.Thibodeaux,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.  Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Portinari Altarpiece

A famous Renaissance painting by Hugo van der Goes, known for its detailed portrayal of the Adoration of the Shepherds.

Subsidiary Scenes

Secondary or additional scenes in artwork that complement the main subject, often providing context or narrative details.

Claus Sluter

A Dutch sculptor who is considered one of the founders of Northern Renaissance sculpture, known for his naturalistic and detailed figures.

Chartreuse de Champmol

A large Carthusian monastery in Dijon, France, founded in the late 14th century, known for its artistic commissions and elaborate sculptures by renowned artists of the time.

Q2: Identify which of the following statements is

Q19: A personal holding company cannot take a

Q33: Acquiring Corporation acquires all of the assets

Q50: If a liquidating subsidiary corporation primarily has

Q60: Which of the following actions cannot be

Q64: The following taxes are deductible as itemized

Q76: How is a claim for refund of

Q83: Max sold the following capital assets this

Q103: In order for an expense to be

Q110: What is required for an individual to