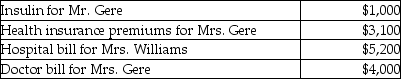

Mr.and Mrs.Gere,who are filing a joint return,have adjusted gross income of $50,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Gere's mother,Mrs.Williams.The Gere's could claim Mrs.Williams as their dependent,but she has too much gross income.  Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Final Step

The last phase in a process or procedure, often crucial for the completion or achievement of the intended outcome.

Transfer

The act of moving or conveying property, rights, or interest from one entity or person to another.

Signing

Signing refers to the act of writing one's name, initials, or mark on a document as a form of acknowledgement, consent, or agreement.

Sodium Chloride

A chemical compound known as table salt, consisting of sodium and chloride ions, essential for various bodily functions including nerve transmission and muscle function.

Q9: On September 1,of the current year,Samuel,a cash-basis

Q17: Toby made a capital contribution of a

Q27: A flood damaged an auto owned by

Q39: Monte inherited 1,000 shares of Corporation Zero

Q73: Acquisition indebtedness for a personal residence includes

Q75: Brown Corporation has assets with a $650,000

Q83: Jason,who lives in New Jersey,owns several apartment

Q95: Rita died on January 1,2014 owning an

Q108: If a taxpayer makes a charitable contribution

Q129: Individuals are allowed to deduct the greater