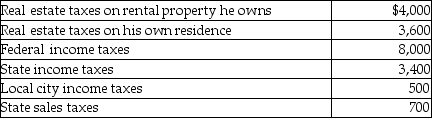

Matt paid the following taxes in 2014:  What amount can Matt deduct as an itemized deduction on his tax return?

What amount can Matt deduct as an itemized deduction on his tax return?

Definitions:

Activating Group

A substituent attached to a reactive center in a chemical compound that increases the compound’s reactivity.

Inductive Destabilization

The destabilization of a molecule due to the transmission of charge through bonds, typically affecting reactivity and stability.

Resonance

A concept in chemistry where a molecule is represented by two or more structures to depict its electron distribution more accurately.

Friedel-Crafts Alkylation

A chemical reaction process that introduces an alkyl group into an aromatic ring, typically using an alkyl halide and a strong Lewis acid catalyst.

Q1: What attributes of a controlled subsidiary corporation

Q19: Erin,Sarah,and Timmy are equal partners in EST

Q25: Wang,a licensed architect employed by Skye Architects,incurred

Q27: The alternative minimum tax is the excess

Q31: The following information is reported by Acme

Q71: Identify which of the following statements is

Q86: Identify which of the following statements is

Q87: Parent Corporation,which operates an electric utility,created a

Q107: Which of the following is not required

Q130: Taxpayers who own mutual funds recognize their