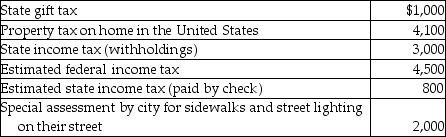

During the year Jason and Kristi,cash basis taxpayers,paid the following taxes:  What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

Definitions:

Middle Generation

The generation of individuals who are between their parents and their children, often responsible for caring for both older and younger family members.

Middle-Aged Woman

A female individual who is in the middle stage of her life, typically considered to be between the ages of about 45 and 65.

Q5: Explain the requirements a group of corporations

Q22: On July 1,in connection with a recapitalization

Q37: Kathleen received land as a gift from

Q51: Discuss why the distinction between deductions for

Q56: P and S are members of an

Q65: Melon Corporation makes its first purchase of

Q72: Arnold Corporation reports taxable income of $250,000,tax

Q87: Identify which of the following statements is

Q96: Pacific Corporation acquires 80% of the stock

Q124: Gabby owns and operates a part-time art