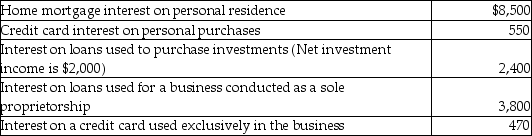

Teri pays the following interest expenses during the year:  What is the amount of interest expense that can be deducted as an itemized deduction?

What is the amount of interest expense that can be deducted as an itemized deduction?

Definitions:

Universities

Institutions of higher education and research, which grant academic degrees in various subjects.

Inventors

Individuals who create or discover a new method, form, device, or other useful means that becomes known as an invention.

General Mills

A multinational manufacturer and marketer of branded consumer foods sold through retail stores, known for products like cereals, snacks, and yogurt.

Patent

Legal protection granted to an inventor or assignee, giving them exclusive rights to use, make, or sell an invention for a certain period of time.

Q61: A taxpayer may deduct a loss resulting

Q69: The liquidation of a subsidiary corporation must

Q71: Identify which of the following statements is

Q76: Which of the following intercompany transactions creates

Q76: In the current year,Julia earns $9,000 in

Q78: Distinguish between the accrual-method taxpayer and the

Q81: The IRS can attempt to collect taxes

Q85: Christopher,a cash basis taxpayer,borrows $1,000 from ABC

Q101: In the current year,Sun Corporation's federal income

Q123: Travel expenses for a taxpayer's spouse are