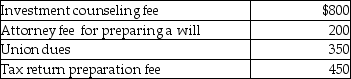

Daniel had adjusted gross income of $60,000,which consisted of $55,000 in wages and $5,000 in dividend income from taxable domestic corporations.His expenses include:  What is the net amount deductible by Daniel for the above items?

What is the net amount deductible by Daniel for the above items?

Definitions:

Justice

A concept of moral rightness based on ethics, law, fairness, and equity, extending to the administration of law, with the aim of punishing wrongdoing and rewarding the right.

Social Media Marketing

Uses social media to influence consumers to purchase products and services.

Platforms

Digital or physical spaces that facilitate the creation, sharing, and engagement of content, services, or products.

Consumers

Individuals or groups who purchase goods and services for personal use.

Q16: Which of the following statements regarding the

Q34: Town Corporation acquires all of the stock

Q39: Parent Corporation purchases all of Target Corporation's

Q52: Identify which of the following statements is

Q60: Under what circumstances does a liquidating corporation

Q70: The NOL deduction is calculated the same

Q78: Mariano owns all of Alpha Corporation,which owns

Q92: On January 1,Alpha Corporation purchases 100% of

Q100: What are the advantages and disadvantages of

Q107: Which of the following is not required