Phoebe's AGI for the current year is $120,000.Included in this AGI is $100,000 salary and $20,000 of interest income.In earning the investment income,Phoebe paid investment interest expense of $30,000.She also incurred the following expenditures subject to the 2% of AGI limitation:

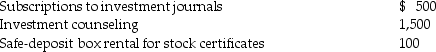

Investment expenses:

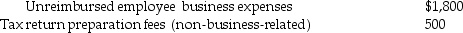

Noninvestment expenses:

Noninvestment expenses:

What is Phoebe's investment interest expense deduction for the year?

What is Phoebe's investment interest expense deduction for the year?

Definitions:

Formal Structures

The officially designated channels of communication and hierarchies within an organization that dictate how tasks are assigned and coordinated.

Vertical Layers

The hierarchical levels or stages within an organization or system, usually indicating positions of authority.

Management

The process of dealing with or controlling things or people, often within an organizational context.

Organizing Team

The process of bringing together a group of individuals to form a coordinated unit, aimed at achieving specific goals and objectives.

Q40: Parent and Subsidiary Corporations are members of

Q41: In 2013 Grace loaned her friend Paula

Q52: Parent Corporation purchases all of Target Corporation's

Q59: Individual taxpayers can offset portfolio income with

Q65: Mirasol Corporation granted an incentive stock option

Q90: Life insurance proceeds are a positive adjustment

Q91: The personal holding company tax<br>A)may be imposed

Q100: A medical expense is generally deductible only

Q105: Joel has four transactions involving the sale

Q112: Hobby expenses are deductible as for AGI