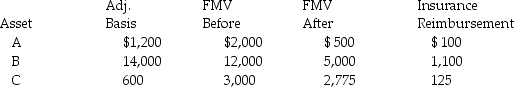

Determine the net deductible casualty loss on the Schedule A for Alan Michael when his adjusted gross income was $40,000 in 2014 and the following occurred:

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

All casualty losses were nonbusiness personal use property losses and none occurred in a federally declared disaster area.

What is the amount of the net deductible casualty loss?

Definitions:

ECG

An electrocardiogram, a test that measures the electrical activity of the heart to detect heart abnormalities.

Ventricule

A term often misspelled or used interchangeably with ventricle, which typically refers to one of the two lower chambers of the heart or a cavity in the brain that contains cerebrospinal fluid.

PR Interval

A measurement on an ECG that represents the time between the start of the atrial depolarization (P wave) and the start of the QRS complex, indicative of atrioventricular conduction.

Tachycardia

A condition characterized by an abnormally fast heart rate, typically more than 100 beats per minute in adults.

Q19: Amy,a single individual and sole shareholder of

Q31: Once an activity has been classified as

Q50: Identify which of the following statements is

Q51: Tax attributes of the target corporation are

Q72: All of the following are allowed a

Q83: When a subsidiary corporation is liquidated into

Q85: Jackson and Tanker Corporations are members of

Q91: Gambling losses are miscellaneous itemized deductions subject

Q97: Carol owns Target Corporation stock having an

Q107: Under Sec.751,unrealized receivables include potential Section 1245