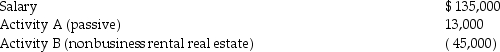

Parveen is married and files a joint return.He reports the following items of income and loss for the year:

If Parveen actively participates in the management of Activity B,what is his AGI for the year and what is the passive loss carryover to next year?

If Parveen actively participates in the management of Activity B,what is his AGI for the year and what is the passive loss carryover to next year?

Definitions:

Clinical Data

Information collected from or about patients in the course of their medical treatment, used for research, diagnosis, and healthcare decision-making.

Prochaska and DiClemente

Psychologists James Prochaska and Carlo DiClemente, known for developing the Transtheoretical Model of change, which outlines stages people go through in altering behavior.

Behavioral Approaches

Psychological methods that focus on modifying observable and measurable behaviors through various techniques like reinforcement and conditioning.

Psychoactive Drug

A chemical substance that affects the brain, altering mood, perception, or behavior, and often used for recreational or therapeutic purposes.

Q42: One of the requirements which must be

Q45: A partnership cannot make charitable contributions.

Q51: Tax attributes of the target corporation are

Q51: Frank is a self-employed CPA whose 2014

Q71: Identify which of the following statements is

Q71: Linda had a swimming pool constructed at

Q75: Limited partners must consider the at-risk,basis,and passive

Q76: In the current year,Julia earns $9,000 in

Q81: During 2014,Marcia,who is single and is covered

Q113: Self-employed individuals may deduct the full self-employment