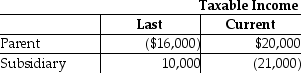

Parent and Subsidiary Corporations form an affiliated group.Last year,the initial year of operation,Parent and Subsidiary filed separate returns.This year.the group files a consolidated return.  How much of the Subsidiary loss can be carried back to last year?

How much of the Subsidiary loss can be carried back to last year?

Definitions:

Personally Meaningful Objects

Items that hold significant personal value or emotional significance to an individual.

Delirium

An acute, often fluctuating state of confusion characterized by impaired perception, thinking, and memory.

Impaired Consciousness

A reduced state of awareness where an individual is less responsive to external stimuli, varying from drowsiness to coma.

Q5: Erin's records reflect the following information: 1.

Q8: If an employee incurs business-related entertainment expenses

Q34: A Sec.332 liquidation requires a complete statement

Q56: Last year,Toby made a capital contribution of

Q57: On January 2 of the current year,Calloway

Q58: Explain what types of tax planning are

Q66: A taxpayer incurs a net operating loss

Q70: In a contributory defined contribution pension plan,all

Q77: Jill is considering making a donation to

Q78: Rod owns a 65% interest in the