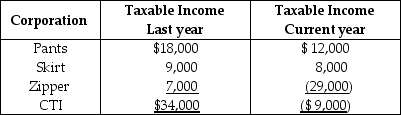

Pants and Skirt Corporations are affiliated and have filed consolidated tax returns for the past three years.Pants acquires 100% of Zipper stock on January 1 of this year.Zipper Corporation filed separate returns previously.Pants,Skirt,and Zipper filed a consolidated return for the current year and reported the following taxable incomes:  The $9,000 consolidated NOL reported in the current year

The $9,000 consolidated NOL reported in the current year

Definitions:

Collateral

Assets pledged by a borrower to secure a loan or credit, which the lender can seize if the borrower defaults.

Defaults

Situations in which parties fail to fulfill their obligations under a contract or agreement.

Recording Mortgage

The process of registering a mortgage deed with the appropriate government office to make it a part of the public record, ensuring legal protection and establishing priority.

Mortgagee

The party who lends money and takes back a mortgage as security for the loan.

Q21: Expenditures incurred in removing structural barriers in

Q51: Tax attributes of the target corporation are

Q64: A closely held C Corporation's passive losses

Q66: Samantha works 40 hours a week as

Q66: Under the MACRS system,depreciation rates for real

Q67: Cardinal and Bluebird Corporations both use a

Q72: The sale of inventory at a loss

Q81: In April of 2013,Brandon acquired five-year listed

Q102: Eicho's interest in the DPQ Partnership is

Q132: Deductible moving expenses include the cost of