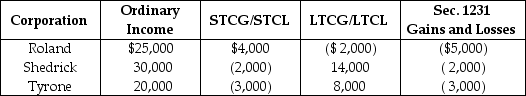

Roland,Shedrick,and Tyrone Corporations formed an affiliated group a number of years ago,which has since filed consolidated tax returns.No prior Sec 1231 losses have been reported by any group member.The group had a consolidated capital loss carryover last year.For the current year,the group reports the following results:  Which of following statements is incorrect?

Which of following statements is incorrect?

Definitions:

Project Risk

The potential for losses or negative outcomes on a project due to various factors such as cost overruns, underperformance, or market changes.

Equity Financing

A method of raising capital by selling company shares to investors, thereby offering them a portion of the ownership.

Weighted Average Cost

An inventory valuation method that calculates inventory and cost of goods sold based on the average cost of all similar items in inventory.

Profitable Project

A project that generates more revenue than its operating and other costs.

Q30: In-home office expenses which are not deductible

Q30: Explain the difference between partnership distributions and

Q36: Stella acquired a 25% interest in the

Q62: Identify which of the following statements is

Q64: The following taxes are deductible as itemized

Q71: Linda had a swimming pool constructed at

Q80: In 2014,medical expenses are deductible as a

Q81: A partner's holding period for a partnership

Q83: On December 31 of last year,Alex and

Q114: Bob contributes cash of $40,000 and Carol