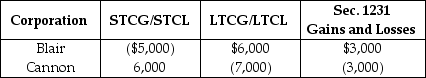

Blair and Cannon Corporations are members of an affiliated group.No prior net Sec.1231 losses have been reported by any group member.The two corporations report consolidated ordinary income of $100,000 and gains and losses from property transactions as follows.  Which of the following statements is correct?

Which of the following statements is correct?

Definitions:

Reward Performance

The practice of recognizing and compensating employees based on their work performance, often aimed at motivating and retaining talent.

Poor Productivity

Lower than expected or desired output or efficiency from a worker or group of workers, affecting overall organizational performance.

Indirect Discrimination

A type of discrimination that occurs when policies, practices, rules, or measures that appear neutral result in unequal treatment or impacts on a particular group without justification.

Anti-Harassment Policies

Guidelines and procedures implemented by organizations to prevent harassment and provide measures to deal with it if it occurs.

Q4: P-S is an affiliated group that files

Q6: On December 1,2014,Delilah borrows $2,000 from her

Q12: A taxpayer owns an economic interest in

Q15: After the stock acquisition,MCI transferred its assets

Q22: A taxpayer's rental activities will be considered

Q36: Mitzi's medical expenses include the following: <img

Q48: Blitzer Corporation is the parent corporation of

Q61: Identify which of the following statements is

Q80: Brandon,a single taxpayer,had a loss of $48,000

Q88: The MACRS system requires that residential real