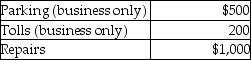

Brittany,who is an employee,drove her automobile a total of 20,000 business miles in 2014.This represents about 75% of the auto's use. She has receipts as follows:  Brittany's AGI for the year of $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method. After application of any relevant floors or other limitations,Brittany can deduct

Brittany's AGI for the year of $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method. After application of any relevant floors or other limitations,Brittany can deduct

Definitions:

Volunteer Recruitment

The process of attracting and enlisting individuals to voluntarily participate in a research study or project.

Anxiety Levels

Refers to the degree or intensity of feeling anxious or stressed, which can vary among individuals and situations.

Cross-National

Pertaining to or involving two or more nations, often used in research to describe studies that compare phenomena across different countries.

Cultural Competence

The ability to understand, communicate with, and effectively interact with people across cultures by acknowledging and respecting their beliefs and behaviors.

Q7: Which of the following statements is incorrect

Q17: A business which provides a warranty on

Q18: Toby Corporation owns 85% of James Corporation's

Q20: A loss on business or investment property

Q22: If a cash basis taxpayer gives a

Q33: Winnie made a $70,000 interest-free loan to

Q38: Define the seven classes of assets used

Q51: What is the tax impact of guaranteed

Q53: If a partner dies,his or her tax

Q129: Edward incurs the following moving expenses: <img