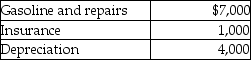

Jordan,an employee,drove his auto 20,000 miles this year,15,000 to meetings with clients and 5,000 for commuting and personal use. The cost of operating the auto for the year was as follows:  Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile. Jordan has used the actual cost method in the past. Jordan's AGI is $50,000. What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile. Jordan has used the actual cost method in the past. Jordan's AGI is $50,000. What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Definitions:

Occupational Discrimination

Unfair treatment of workers based on characteristics unrelated to job performance, such as race, gender, or religion.

Universal Basic Income

is a social welfare program where a government provides its citizens with a regular, unconditional sum of money, regardless of employment status or income.

Incentives To Work

Factors or motivations that encourage individuals to participate in the workforce, including wages, benefits, and working conditions.

Business Cycle

Recurring increases and decreases in the level of economic activity over periods of years; consists of peak, recession, trough, and expansion phases.

Q5: Explain the requirements a group of corporations

Q26: Tobey receives 1,000 shares of YouDog! stock

Q27: Intangible drilling and development costs (IDCs)may be

Q38: In order for an asset to be

Q40: The Section 179 expensing election is available

Q43: Losses incurred in the sale or exchange

Q49: Why was Section 1244 enacted by Congress?

Q64: What are the advantages of a triangular

Q85: Broom Corporation transfers assets with an adjusted

Q93: An accountant takes her client to a