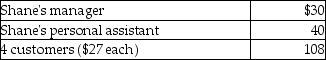

Shane,an employee,makes the following gifts,none of which are reimbursed:  What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

Definitions:

Economic Inefficiency

A situation where resources are not allocated optimally, leading to waste or an outcome where potential gains are not fully realized.

Production Possibilities Curve

A graphical representation that shows the maximum possible output combinations of two goods or services an economy can achieve when all resources are fully employed.

Market Prices

The amounts at which goods and services can be bought or sold in open markets.

Resource Substitutability

The degree to which different inputs (or resources) can be substituted for one another in the production process.

Q16: A subsidiary corporation filing a consolidated return

Q33: Acquiring Corporation acquires all of the assets

Q38: Identify which of the following statements is

Q42: If a partnership chooses to form an

Q44: In calculating depletion of natural resources each

Q66: Parent Corporation owns all of the stock

Q67: Yong contributes a machine having an adjusted

Q74: As part of a plan of corporate

Q91: Gambling losses are miscellaneous itemized deductions subject

Q105: A taxpayer can deduct a reasonable amount