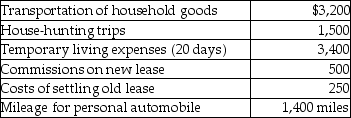

Ron obtained a new job and moved from Houston to Washington.He incurred the following moving expenses:  Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Definitions:

Caffeine

A stimulant found in coffee, tea, and various foods and drinks that affects the central nervous system, increasing alertness.

Widely Used Drug

A substance that is commonly consumed or applied for its physiological and psychological effects.

Physical Dependence

A physiological state of adaptation to a substance, manifested by the development of withdrawal symptoms when the substance is reduced or stopped.

Caffeine

A stimulant of the central nervous system present in coffee, tea, and various foods and drinks, known to enhance alertness and reduce fatigue.

Q35: On October 2,2014,Dave acquired and placed into

Q40: Charles Jordan files his income tax return

Q46: Cardinal and Bluebird Corporations both use a

Q66: Deferred compensation refers to methods of compensating

Q67: Prithi acquired and placed in service $190,000

Q76: In the current year,Julia earns $9,000 in

Q80: In-home office expenses are deductible if the

Q82: Which of the following statements is true?<br>A)A

Q103: What are the three rules and their

Q122: Bill obtained a new job in Boston.He