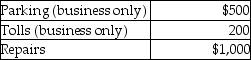

Chelsea,who is self-employed,drove her automobile a total of 20,000 business miles in 2014.This represents about 75% of the auto's use. She has receipts as follows:  Chelsea has an AGI for the year of $50,000.Chelsea uses the standard mileage rate method. After application of any relevant floors or other limitations,she can deduct

Chelsea has an AGI for the year of $50,000.Chelsea uses the standard mileage rate method. After application of any relevant floors or other limitations,she can deduct

Definitions:

Homework Assignments

Tasks assigned by educators to students that are meant to be completed outside of classroom hours, intended to reinforce learning.

Subjectivity

The quality of being influenced by personal feelings, tastes, or opinions in contrast to objective facts.

Systematic Desensitization

A therapy technique used to reduce phobia or anxiety through gradual exposure to the feared object/situation combined with relaxation exercises.

Afraid of Flying

A specific phobia involving an intense, persistent fear of being on an airplane or the thought of flying.

Q12: Identify which of the following statements is

Q30: In-home office expenses which are not deductible

Q35: On October 2,2014,Dave acquired and placed into

Q35: A consolidated return's tax liability is owed

Q42: Atiqa took out of service and sold

Q43: Do most distributions made by a partnership

Q66: Under the MACRS system,depreciation rates for real

Q76: Bao had investment land that he purchased

Q97: What types of corporations are not includible

Q113: The holding period of a partnership interest