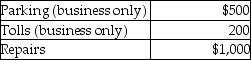

Brittany,who is an employee,drove her automobile a total of 20,000 business miles in 2014.This represents about 75% of the auto's use. She has receipts as follows:  Brittany's AGI for the year of $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method. After application of any relevant floors or other limitations,Brittany can deduct

Brittany's AGI for the year of $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method. After application of any relevant floors or other limitations,Brittany can deduct

Definitions:

Productivity Measurement

The process of quantifying the efficiency and effectiveness of production.

Precise Units

Measurement or quantities described with accuracy and exactness, often in the context of manufacturing or science.

Workforce Size

The total number of employees, both full time and part time, engaged in an organization or available in the market.

Equipment Used

Equipment used refers to the tools, machinery, and devices employed in the execution of a specific task or operation.

Q1: If a loan has been made to

Q11: A partner's basis for his or her

Q12: Identify which of the following statements is

Q12: All of the following are deductible as

Q24: Ruby Corporation grants stock options to Iris

Q27: Which of the following statements is incorrect

Q47: Albert contributes a Sec.1231 asset to a

Q51: Intangible assets are subject to MACRS depreciation.

Q87: Parent Corporation,which operates an electric utility,created a

Q89: Freida is an accrual-basis taxpayer who owns