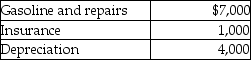

Rajiv,a self-employed consultant,drove his auto 20,000 miles this year,15,000 to meetings with clients and 5,000 for commuting and personal use. The cost of operating the auto for the year was as follows:  Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What is Rajiv's deduction for the use of the auto after application of all relevant limitations?

Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What is Rajiv's deduction for the use of the auto after application of all relevant limitations?

Definitions:

Headscarf

A piece of fabric worn on the head for a variety of reasons including religious observance, cultural tradition, or fashion.

Political Rally

A large public gathering of people organized to support or oppose political candidates, parties, or policies, often featuring speeches and demonstrations.

Undue Hardship

Circumstances involving cost, or health or safety issues that would make it impossible or very difficult for an employer or service provider to meet the duty to accommodate.

Ontario Human Rights Commission

A governmental commission that promotes and enforces human rights in the Canadian province of Ontario.

Q3: A stock acquisition that is not treated

Q5: David purchased a 10% capital and profits

Q24: Ruby Corporation grants stock options to Iris

Q48: Van pays the following medical expenses this

Q54: Identify which of the following statements is

Q68: Explain when the cost of living in

Q71: Identify which of the following statements is

Q81: In 2014,Richard's Department Store changes its inventory

Q90: When preparing a tax return for a

Q97: Personal travel expenses are deductible as miscellaneous