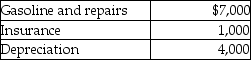

Jordan,an employee,drove his auto 20,000 miles this year,15,000 to meetings with clients and 5,000 for commuting and personal use. The cost of operating the auto for the year was as follows:  Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile. Jordan has used the actual cost method in the past. Jordan's AGI is $50,000. What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile. Jordan has used the actual cost method in the past. Jordan's AGI is $50,000. What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Definitions:

Direct Labor Cost

The total cost of employment for employees who directly contribute to the production of goods or services, including wages and benefits.

Machine-Hours

A measure of the total time that machines are operating in a manufacturing process.

Predetermined Overhead Rate

The predetermined overhead rate is calculated by dividing estimated overhead costs by an allocation base, such as direct labor hours, to allocate overhead costs to products or services.

Manufacturing Overhead

All indirect costs related to the production process, such as the costs of maintenance, supplies, and utilities, excluding direct materials and direct labor.

Q13: Victor and Kristina decide to form VK

Q21: Shane,an employee,makes the following gifts,none of which

Q29: Dan purchases a 25% interest in the

Q66: Identify which of the following statements is

Q75: On January l Grace leases and places

Q79: Identify which of the following statements is

Q80: Brandon,a single taxpayer,had a loss of $48,000

Q80: For tax purposes,the lower of cost or

Q83: Most taxpayers elect to expense R&E expenditures

Q113: Self-employed individuals may deduct the full self-employment