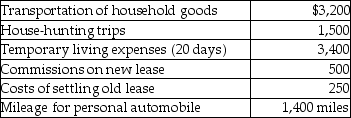

Ron obtained a new job and moved from Houston to Washington.He incurred the following moving expenses:  Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Definitions:

Financing Activities

Transactions and events that affect the equity and long-term liabilities of a company, reflecting how it raises funds and repays its investors.

Operating Activities

Activities that relate to the primary operations of a company, such as selling products or services and administrative expenses.

Taxes

Compulsory charges imposed by governments on individuals or entities to fund public services and infrastructure.

Investing Activity

Transactions involving the purchase and sale of long-term assets and investments, part of a company's cash flow statement that indicates how funds are used and generated.

Q1: If a loan has been made to

Q7: Martha owns Gator Corporation stock having an

Q27: Discuss the timing of the allowable medical

Q42: Which of the following statements is true?<br>A)The

Q55: All of the following are true of

Q73: Acquisition indebtedness for a personal residence includes

Q74: As part of a plan of corporate

Q101: An installment sale is best defined as<br>A)any

Q108: The XYZ Partnership reports the following operating

Q123: Travel expenses for a taxpayer's spouse are