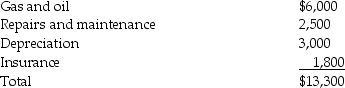

Sarah purchased a new car at the beginning of the year. She makes an adequate accounting to her employer and receives a $2,400 (12,000 miles × 20 cents per mile)reimbursement in 2014 for employment-related business miles.She incurs the following expenses related to both business and personal use:

She also spent $200 on parking and tolls that were related to business.During the year she drove a total 20,000 miles.

She also spent $200 on parking and tolls that were related to business.During the year she drove a total 20,000 miles.

What are the possible amounts of Sarah's deductible transportation expenses?

Definitions:

Entrepreneurial Innovation

The process by which an entrepreneur designs, develops, and brings to the market a novel product or service that potentially changes industry patterns or consumer habits.

Subsidize

To provide financial support or assistance, often by the government, to lower the cost of producing goods or services.

Ideas In Motion

The concept of actively pursuing and implementing new ideas and innovations.

Money Rate

The rate of interest charged on short-term loans by banks to their customers.

Q7: During the year,Patricia realized $10,000 of taxable

Q40: Takesha paid $13,000 of investment interest expense

Q42: One of the requirements which must be

Q59: Tenika has a $10,000 basis in her

Q78: Identify which of the following statements is

Q83: If a distribution occurs within _ years

Q90: If an individual is not "away from

Q98: Acquiring Corporation acquires at the close of

Q106: Businesses can recognize a loss on abandoned

Q129: Edward incurs the following moving expenses: <img